A whole host of celebrity investors, including Republic of Ireland Internationals Robbie Keane and John O'Shea, are potentially facing a big tax bill following a recent tax tribunal in the UK.

Celebrities that invested in film finance schemes with a group called Ingenious Media, claimed losses of over £1.62 billion. The tribunal found partly in favour of the UK’s HM Revenue and Customs (HMRC) against the schemes set up by Ingenious.

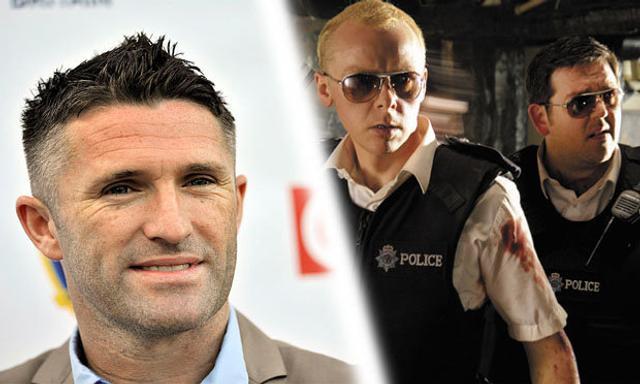

For nearly thirteen years, Ingenious have put together film finance partnerships with high profile figures from the worlds of entertainment, media and sport. Investors over the years included Republic of Ireland Manager Martin O'Neill and former Irish internationals, Denis Irwin, Clinton Morrison and David O'Leary.

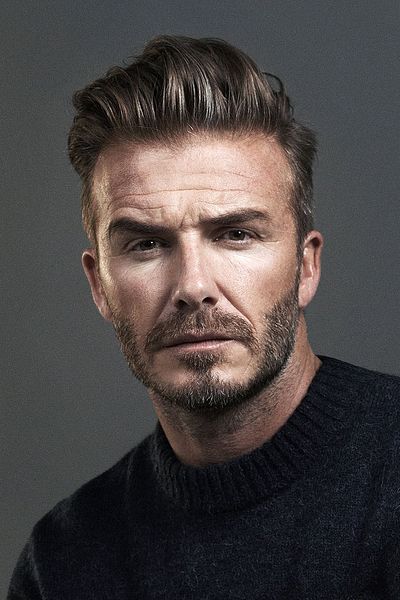

Premier League footballers were particularly prominent with David Beckham, Eidur Gudjohnsen, Emile Heskey, Stuart Pearce, David May and Jamie Carragher all named.

Musicians Peter Gabriel, Annie Lennox and Spice Girls singers Victoria Beckham, Geri Halliwell and Mel C also invested in the schemes at various points.

The partnerships provided the financing for both Hollywood blockbusters and Independent productions with Avatar, Die Hard 4, Hot Fuzz and Shaun of the Dead all said to have received funding from the schemes.

The investments often resulted in heavy accounting losses for the partnerships in their early years due to a complex series of transactions. The celebrities were then able to use these losses to reduce their tax bills on other income.

However, the HMRC asserted that the tax reliefs claimed by scheme members were excessive. Three Ingenious partnerships took a case to a UK tax tribunal to challenge this assertion. Although the tribunal accepted some of Ingenious' arguments, they ruled that the losses claimed were excessive in some of the schemes.

Ingenious Media have always maintained that the schemes were genuine film finance schemes and not tax avoidance vehicles.

The celebrities who invested in the schemes now face the possibility of large demands for tax repayments from HMRC.

Via The Irish Times